Bankruptcy Lawyer In New Haven, CT

If you are facing bankruptcy, you may need the help of our New Haven, CT bankruptcy lawyer who has established a strong record of educating and assisting clients with their unique financial issues. We understand the impact that debt issues can have on the livelihood of a person and their family. Debt can mount very quickly, and sometimes there are limited solutions left. Through this difficult period in your life, a lawyer will be able to provide much-needed guidance and support so that you are fully aware of your options, including bankruptcy and possible alternatives. When you choose Eric Lindh Foster Law, LLC, you’re choosing a dedicated attorney who answer all of your questions and come up with the best possible plan for your unique situation.

Our business and bankruptcy firm has provided clients going through financial struggles for decades. With a strong background in providing debt relief assistance to many clients for over 28 years, we possess the skills and experience required to offer meaningful and effective solutions. We believe in providing high-quality and accessible legal services to our clients and have delivered excellent outcomes. Through our excellent customer service that they have provided over their years of practice, we have helped many clients navigate their financial issues and start fresh. If you have a large amount of debt and are in need of urgent solutions to settle them, schedule a risk-free consultation with our Connecticut bankruptcy attorney.

What You Should Consider Before Filing For Bankruptcy

Filing for bankruptcy is a major decision, and the type of bankruptcy you file for depends on your unique circumstances as well as a number of factors. What is the combined value of the assets that you have? Are you interested in debt consolidation or organization? Determine your needs and priorities to find out which one is suitable for you. Chapter 7 bankruptcy allows you to eliminate many kinds of debt and often takes a few months to complete, while Chapter 13 allows you to pay your debts over several years. Make sure you understand the differences between the bankruptcy types and their respective requirements by talking with our experienced New Haven bankruptcy lawyer, who can explain each process in detail. Here’s a brief overview:

Chapter 7 Bankruptcy

Unlike Chapter 13 bankruptcy, Chapter 7 bankruptcy relief is only available to individuals and families that don’t earn much income. Why? The Chapter 7 bankruptcy process doesn’t require filers to repay their dischargeable debts. At the end of the bankruptcy process, Chapter 7 filers have their dischargeable debts wiped clean without any obligation to repay their creditors. It isn’t hard to see why the law has reserved this kind of relief for those who are least likely to be able to repay their debts any time soon.

Note that this type of bankruptcy is occasionally not the best option for low-income filers. Chapter 7 filers have a trustee assigned to their case. This trustee is empowered to sell any of the filer’s assets that are not exempt per the bankruptcy code. Most low-income filers don’t need to worry about this challenge, as their property is exempt. However, low-income filers that own valuable luxury property may be at risk of having this property sold to repay their creditors. In such instances, the team at Eric Lindh Foster Law, LLC may recommend that a filer explore Chapter 13 bankruptcy or a non-bankruptcy alternative to managing their debt.

Chapter 13 Bankruptcy

If you don’t qualify for Chapter 7 bankruptcy (or you do but it isn’t the best option for you), you may be able to manage your debt via the Chapter 13 bankruptcy process. This process requires filers to construct a repayment plan that will last from 3-5 years. This repayment plan is structured so that monthly debt payments are manageable. At the end of a successful repayment period, all of the filer’s remaining dischargeable debt is wiped clean.

Other Bankruptcy And Non-Bankruptcy Options

If you own a business and your debt is primarily business-related, our firm’s New Haven bankruptcy and business lawyer can help you file for Chapter 11 business bankruptcy relief. If filing for bankruptcy isn’t the best option for your situation (personally or professionally), the experienced Connecticut legal team at Eric Lindh Foster Law, LLC can help you to explore non-bankruptcy debt management alternatives. These alternatives may include debt settlement, crafting a debt management plan, or debt consolidation. Everyone’s needs are different and our firm’s bankruptcy law attorney takes that reality into serious consideration when managing clients’ cases.

Will Filing For Bankruptcy Ruin Your Life?

There is a common misconception that filing for bankruptcy will completely destroy your credit and that you will not be able to fully recover after doing this. This is simply not true. Filing for bankruptcy typically should not be the step people go to immediately, but it can be the best decision for many who find themselves in financial turmoil. It is true that your credit score may be lower temporarily, but over time it will recover. Don’t let the initial disadvantages deter you from making the best decision to get rid of your debt issues. Many people who file for bankruptcy are able to get in a better financial position than they were prior to filing for bankruptcy.

The most important thing will be consulting with an experienced bankruptcy lawyer in New Haven, Connecticut. At Eric Lindh Foster Law, LLC, we can go over your different options and choose the best route for you personally. Every situation is unique and needs to be treated that way. This is why a consultation will be helpful in figuring out what the best possible option will be for you and your family. If you are torn between multiple options, a bankruptcy lawyer can help you arrive at a decision.

While any sort of financial issue can cause a lot of stress, remember that there are resources for you to use. Our lawyer can be there to support you so that you don’t have to figure out the bankruptcy process alone.

Tips For Managing Your Credit Score

When you file for bankruptcy, you may be concerned about how your credit score will recover. Though it can take some time for your score to get back to a healthy range again, there are things you can do to improve it Follow these tips so that you can maintain a healthy credit score:

- Check for any suspicious activity. As you review your transactions and credit reports, look for any transactions that you did not authorize. If you notice anything that you do not recognize, contact your bank and let them know. You may also notify the Federal Trade Commission (FTC) To catch issues sooner, you can choose to have fraud alerts sent to you so that you can be notified right away of anything suspicious.

- Make payments on time. A good way to keep your credit score high is to make regular payments. Try making payments well before the date they are due to allow time for processing. It also allows for a few days in between in case there is an issue with the payment. Having too many missed payments can cause your credit score to fall.

- Use your credit card wisely. Going over your credit limit can put a dent on your score. While you are encouraged to use your credit responsibly by making periodic purchases to slowly build up your credit, make sure you are putting limits on yourself. Spending more than 30% can affect your credit score, so always keep an eye on your spending habits.

- Review annual credit reports. It is a good habit to review your credit report annually so that you can monitor your credit history and keep a lookout for suspicious activity. Look for any accounts or payments you are not familiar within your report. Experian, TransUnion, and Equifax are the credit reporting agencies where you can request an annual credit report. Reviewing your credit report on a regular basis helps to prevent you from becoming a victim of fraud and identity theft.

Financial Recovery After Bankruptcy

As you search for the right solution that will bring you debt relief, it’s important to note that bankruptcy does have its benefits. For many people, it can be a sensible solution for wiping out debt they are unable to pay. While bankruptcy does diminish your credit, many people who file for bankruptcy tend to see their credit recover shortly after bankruptcy.

A lawyer can help you weigh the pros and cons of bankruptcy more clearly during a consultation. Ultimately it will be your decision on what you would like to do, but we can answer any questions you may have and figure out a plan to move forward with confidence. All is not lost and you do not need to feel like there is impending doom. We can sort everything out so that you can begin to move on with your life. Our Connecticut bankruptcy lawyer from Eric Lindh Foster Law, LLC is incredibly experienced in this type of law and will be able to give you wise legal advice and avoid common mistakes. We have seen such a wide range of circumstances that we will be able to give you examples of how bankruptcy may help and hurt you.

The most important thing to move forward will be to take all of the pros and cons and figure out which outweighs the other. Knowledge is power. You can take your financial future into your own hands so that you can have some power over your life again.

Is Bankruptcy An Option For Your Business?

Businesses sometimes come to an end because they can no longer bring in enough income to support the expenditures. When a business has insurmountable debt and cannot find another way to raise capital or increase income, it may be best to file for bankruptcy. There are several different types of bankruptcies, and depending on how the business is organized, the business may have more than one option to choose from.

Chapter 11

Businesses can file for Chapter 11 bankruptcy if they wish to reorganize their debt and set a payment plan to repay all their creditors. This can be a good plan if the business expects to raise its revenue in the future and selling its currents assets in another form of bankruptcy will result in bigger losses. After the initial filing, the business still remains under the control of the owners. However, a trustee may be appointed if there is an allegation of management or fraud.

Chapter 11 bankruptcy presents some advantages to the business in that it can void existing contracts, including contracts with employees and suppliers. However, the business is also closely monitored during the bankruptcy process, and cannot make any moves, like selling off major assets, without court approval.

Chapter 7

Businesses can also file for Chapter 7 bankruptcy. This kind of bankruptcy allows the business to discharge its debts. Owners of sole proprietorships can file for Chapter 7 bankruptcy in order to discharge their personal debts along with those of the business. Generally, once a business files for Chapter 7 bankruptcy, the business cannot be operated anymore. Business assets that are deemed non-exempt are liquidated or sold to pay off creditors.

Chapter 13

For businesses that are organized in such a way that they are not a separate legal entity from the owner, the owner may file for Chapter 13 bankruptcy to eliminate debt. Business entities such as corporations cannot file for Chapter 13 bankruptcy. Like Chapter 11, this form of bankruptcy allows the person filing for bankruptcy to reorganize his debts and enter a repayment plan to pay off part or all of the debt.

For some businesses it may be better to restructure debts instead of filing for bankruptcy. In some cases, it may also be cheaper to restructure debt than file for bankruptcy. Debt restructuring can be done through negotiating down the existing debt, for example by extending the time it will take to pay back the debt. When discussing your options with our bankruptcy lawyer in New Haven, CT, debt restricting should be discussed as an option.

3 Ways To Build Back Credit After Bankruptcy

Most people hope to never experience bankruptcy. Although it is not an ideal situation, there are times when filing bankruptcy is the only way to salvage your financial life. Bankruptcy often allows individuals to start over with a clean slate, and hopefully to make better financial choices in the future. The legal team at Eric Lindh Foster Law, LLC wants to help clients understand that they can bounce back after bankruptcy. Here are 3 ways you can start to build back your credit following a bankruptcy.

Take Financial Management Classes

It can sometimes be difficult to admit we need help, but you might benefit greatly from financial management classes. These types of classes help individuals learn how to manage their money and how to identify the challenges that are holding them back from true financial freedom.

Some classes are free of charge and may even help you establish credit again with lenders who specialize in helping people build back their credit.

Look For Credit Building Lenders

There are many types of credit building services available today to help people build their credit back after they have filed with a bankruptcy lawyer in New Haven, CT. These companies work with you to slowly extend credit in a way that you can easily manage. This helps families to re-establish their credit and build financial stability.

Make Payments On Time

You can start to build back your credit by making all monthly payments on time. Even payments for utilities and rent can sometimes help in the is area. The most important thing is that you start to establish healthy money habits. Healthy money habits will ensure that you recover from your bankruptcy and that you can make more confident money decisions in the future.

Stick To Your Budget

It is imperative that you establish a budget and stick to it. A budget keeps you stay accountable with your money so that you do not fall back into the old money habits you had in the past. Although many people feel that a budget is restrictive, the truth is a budget will actually give you the freedom to do the things you really want to do with your money long term.

If you would like to learn more about bankruptcy, the legal team at Eric Lindh Foster Law, LLC can help.

Bankruptcy Statistics

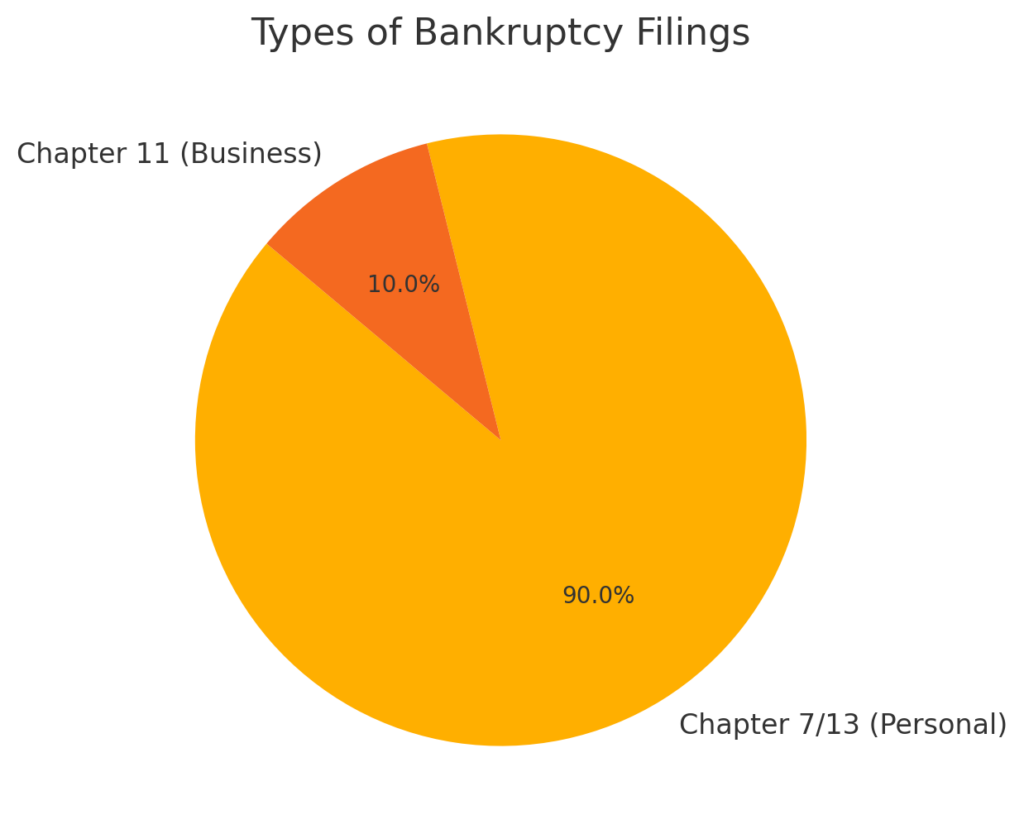

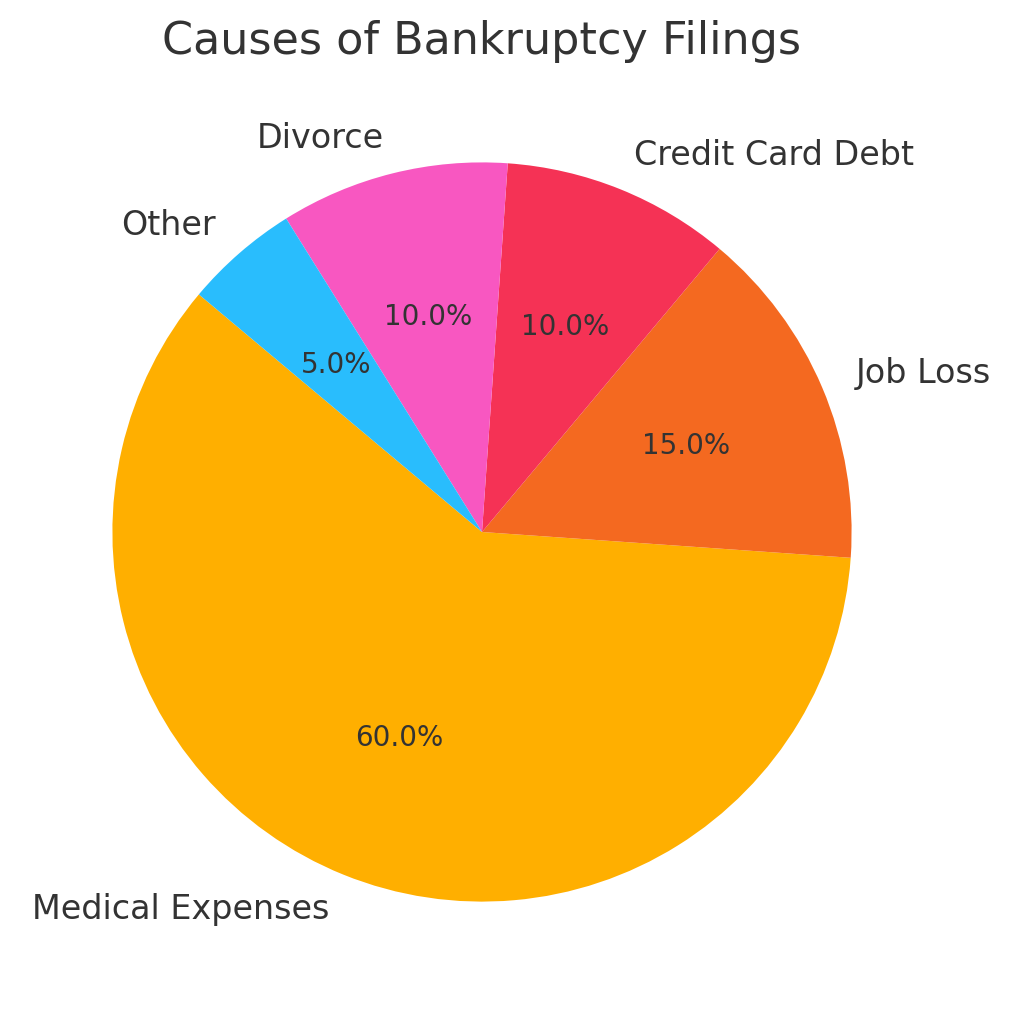

Bankruptcy filings are a common solution for financial distress in the U.S., with over 90% of cases being personal bankruptcies under Chapter 7 or Chapter 13. Medical expenses are a leading cause, contributing to approximately 60% of filings. Job loss, excessive credit card debt, and divorce are other significant factors.

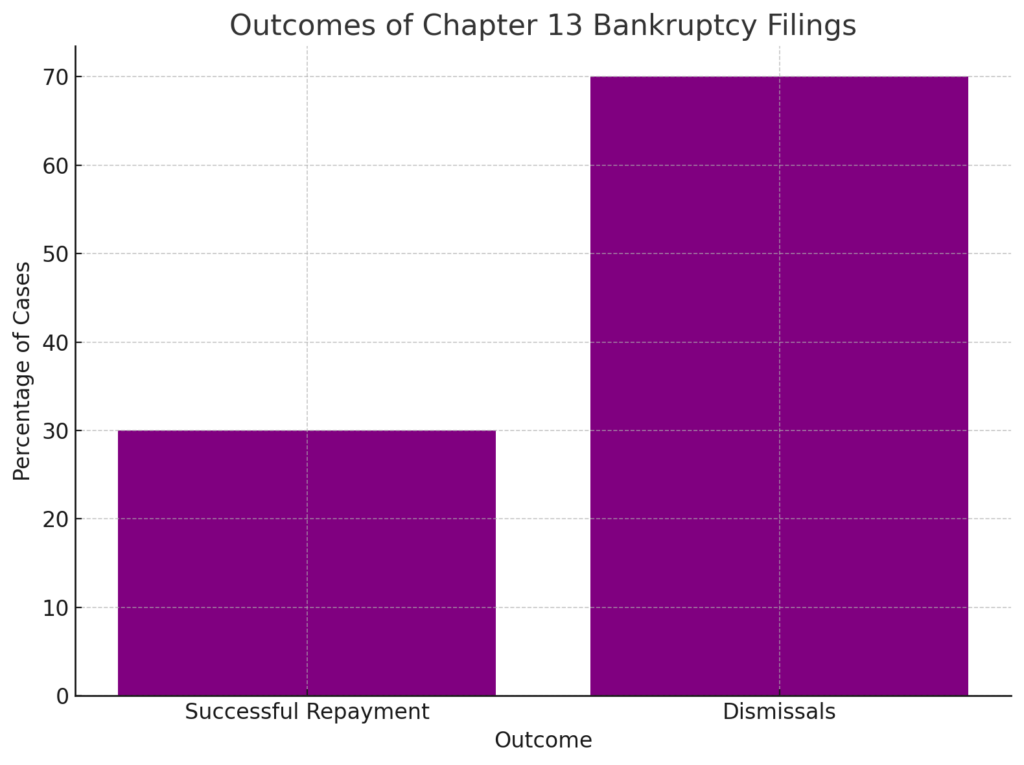

Business bankruptcies typically fall under Chapter 11, focusing on restructuring. Around 70% of Chapter 13 filers fail to complete repayment plans, leading to case dismissals. Bankruptcy rates vary by state, with the highest filings in the Southeast.

The most recent stats from the United States Courts showed that for 2022, bankruptcy filings dropped 6.3% from the previous year (a drop from 413,616 filings to 387,721).

Bankruptcy filings hit an all-time high in 2005, when more than two million cases were filed. In that year, one out of every 55 households filed for bankruptcy.

Bankruptcy FAQs

Bankruptcy FAQs

Can I Keep Some Of My Credit Cards If I File Bankruptcy?

No. When you file for relief, your attorney includes all of your debts in the case. You do not get to choose to keep some of your credit cards. Credit cards are unsecured debt, meaning that you don’t have collateral to protect that debt. In this situation, all unsecured debt gets discharged. An attorney from Eric Lindh Foster Law, LLC can review your accounts and advise you on what may or may not be included in your case.

Am I Allowed To Keep My Vehicle When I File Bankruptcy?

You may be able to remove your secured debt, such as your car or home, from the case. You must continue to make your monthly payments on these items, so the bank doesn’t try to collect its property. If you own your vehicle or home outright, you may be able to keep that property and the equity in it. Each state has different limits to the amount of equity you can save when you file bankruptcy, so reach out to Eric Lindh Foster Law, LLC to review your case. Depending on the state’s requirements, you may need to sell that property to pay off your existing debts.

Do I Need To Use My Retirement Funds To Pay Off My Debt?

Money set aside for your retirement is usually exempt from bankruptcy. This means the trustee cannot access these funds to pay off your other debt. Our attorney may advise you not to use that money to pay off your debt unless you can pay off the entire balance. You don’t want to find yourself in a situation where you use all your retirement funds and still have to file bankruptcy. If you cannot pay off your debt balance in full, keep your retirement secure in your account.

Does Filing For Bankruptcy Stop A Lawsuit Against Me?

Yes, an automatic stay begins as soon as you file, and it halts all collection activity immediately, including lawsuits. You should stop receiving all phone calls, and lawsuits get put on hold. If someone continues to pursue collecting your debt, contact our New Haven bankruptcy lawyer to halt this activity. Even though this stay stops these pursuits, you may need to resume paying debts such as federal taxes or child support when your case closes.

When Should I Meet With A Lawyer?

As soon as you can. Your attorney will know all of the necessary procedures, deadlines, and other formalities to help make sure that this process goes according to plan and as smoothly as possible.

4 Myths About Bankruptcy

If you live in Connecticut and find yourself mired in debt, you may be considering filing for bankruptcy. This is never an easy decision, but when debt mounts and creditors call day and night to collect what they are owed, it may provide you with options for discharging or reorganizing your accounts.

1. Bankruptcy Erases All Debt

Under Chapter 7 bankruptcy, much of your debt is eligible for discharge, including credit card charges, utility bills and rent or mortgage payments. However, child support arrears, most student loans, and back taxes are usually not eligible for discharge. A bankruptcy law firm, such as Eric Lindh Foster Law, can guide you and your individual needs as you navigate bankruptcy.

2. It Is Difficult To File

You may feel hesitant to file for bankruptcy because the paperwork process seems difficult. While some aspects can be tricky, our Connecticut bankruptcy firm can help you with organizing the paperwork and information required. You can find many documents related to Chapter 7 and Chapter 13 bankruptcy online, and with the guidance of your attorney, filing need not be an arduous process.

3. Bankruptcy Ruins Your Credit

You may feel anxious about filing for bankruptcy because of what it means for the future of your credit. While filing Chapter 7 or 13 will likely limit your credit options for up to 10 years, filing may actually improve your score once the debt is discharged. A bankruptcy firm like Eric Lindh Foster Law can help you decide whether liquidation or reorganization of your debt is the better choice for your individual situation.

4. You End Up With Nothing

When you think of bankruptcy, you may imagine creditors taking away everything you own and leaving you penniless. This is a common myth, but you can rest assured that even a Chapter 7 liquidation has exemptions that allow you to keep some of your property. Items necessary for employment, such as motor vehicles, are usually exempt but you may have to give up a second vehicle unless you can prove it is necessary in keeping you or your spouse employed.

Making the choice to declare bankruptcy is never easy, but you do not need to face the future alone. We can guide you through the process and give you hope for a better financial future.

Why Hire Us?

If you are facing bankruptcy that most likely means that your financials are not in the best condition, which probably has you weighing the pros and cons of hiring a lawyer to represent you. The answer is that it is almost always yes, but it does depend on your specific financial situation.

Our Connecticut bankruptcy attorney will be able to make sense of your financial circumstances, including the types and amounts of the debts that are overwhelming you. We will be able to determine if bankruptcy is even the next logical step for you and if it isn’t then you will be able to work with a lawyer to figure out a plan of action to take to reduce your debt.

Depending on which chapter you decide to pursue, your lawyer will be able to guide you through the steps involved like:

- Submitting a list of creditors to the court and scheduling court appearances.

- Directing you on where and how to complete a required pre-bankruptcy credit counseling session and a post-bankruptcy debt management course.

- Submitting required fees when filing documents with the court.

Contact Our Law Firm

The right legal guidance can help you evaluate your options and choose the best path for your business and personal needs. Don’t wait to address serious financial matters—taking action now can set you on the path to rebuilding your finances and securing a brighter future. Schedule a consultation with our bankruptcy lawyer in New Haven, CT today to explore your options and begin moving forward with confidence. We’ll work to fit you into our schedule promptly so you can stop worrying and start feeling empowered about your financial future. Contact us now to get started.